Unlocking the Digital Future: Buying ETH with a Credit Card Simplified

In the electrifying realm of cryptocurrencies, Ethereum (ETH) stands tall as a beacon of innovation and potential. As enthusiasts and investors alike seek to partake in this digital revolution, the ability to buy ETH with credit card has opened a gateway of accessibility and convenience. This comprehensive article is tailored to guide you through the process of buying ETH using credit card, unraveling the intricacies, opportunities, and considerations involved in this modern financial maneuver.

ETH: A Glimpse into the World of Endless Possibilities

Ethereum, often hailed as the queen of cryptocurrencies, represents more than just a digital asset. It’s the foundation of a decentralized platform known for its smart contract functionality, underpinning a vast ecosystem of decentralized applications (DApps). The allure of Ethereum is not just in its technological prowess but in its potential to reshape industries and redefine the way we interact with the digital world.

The Convergence of Traditional and Digital Finance

Buying ETH with a credit card symbolizes the merging of traditional financial systems with the burgeoning world of digital currencies. This convergence brings the ease and familiarity of credit card transactions to the dynamic world of Ethereum, making it more accessible to a broader audience.

The Process: A Step-by-Step Guide to Buying ETH with a Credit Card

The journey of purchasing ETH using a credit card involves several key steps, each crucial in ensuring a smooth and secure transaction:

- Selecting a Reliable Platform: Choosing the right cryptocurrency exchange or platform is the first critical step. Look for platforms that are reputable, secure, and offer the option to buy ETH with a credit card. Binance, Coinbase, Kraken, and Bitstamp are some of the popular exchanges that provide this service.

- Creating and Securing Your Account: Once you’ve chosen a platform, the next step is to set up an account. This process typically involves providing personal information and completing a verification process to comply with regulatory requirements. Ensuring the security of your account with strong passwords and two-factor authentication is paramount.

- Linking Your Credit Card: After account verification, the next step is to link your credit card to your account. This usually involves entering your card details and possibly a verification process by your card issuer.

- Purchasing ETH: With your credit card linked, you can now purchase ETH. Navigate to the purchase section, select Ethereum (ETH) as the cryptocurrency to buy, enter the amount, and choose your credit card as the payment method. Review the transaction details, including fees and exchange rates, before confirming the purchase.

- Transferring ETH to a Secure Wallet: After purchasing ETH, it’s advisable to transfer your holdings to a private wallet for enhanced security. Hardware wallets or secure software wallets are preferred choices.

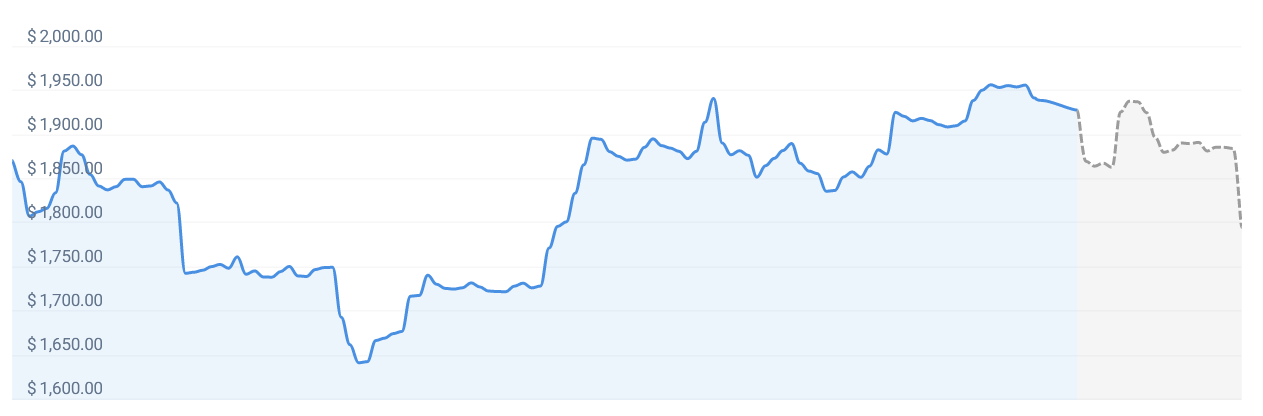

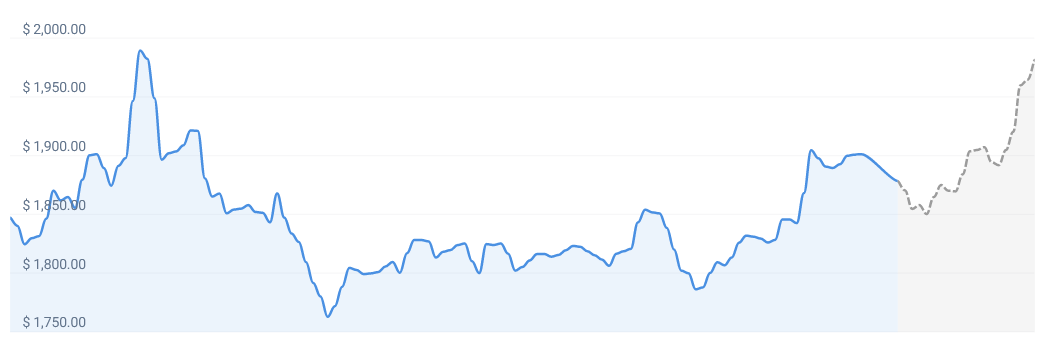

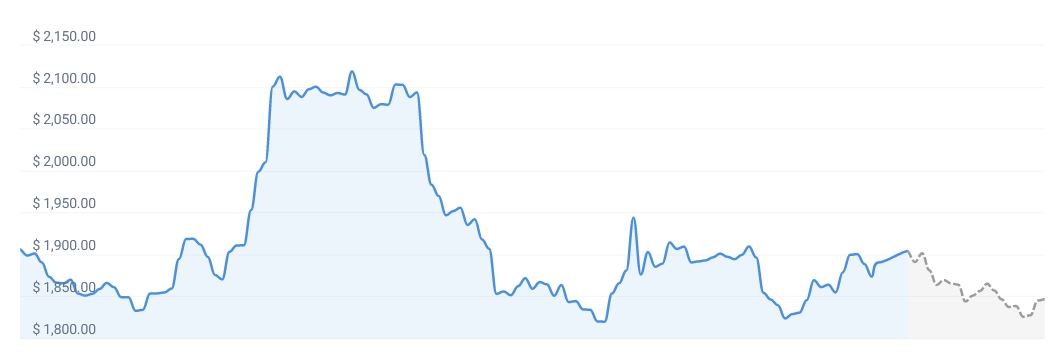

Timing Your Purchase: Navigating Market Volatility

The cryptocurrency market is known for its volatility. Timing your purchase can be crucial, especially considering the price fluctuations of Ethereum. Keeping an eye on market trends and performing due diligence can aid in making an informed decision.

Understanding the Fees: Navigating the Costs of Convenience

Buying ETH with a credit card comes with associated fees. These can include transaction fees, processing fees by the credit card company, and possibly higher exchange rates. Being aware of these fees and comparing different platforms can help in minimizing costs.

Regulatory Landscape: Staying Informed and Compliant

The regulatory framework surrounding cryptocurrencies varies by region and is continually evolving. Staying informed about the regulations in your jurisdiction, especially concerning credit card transactions for cryptocurrency purchases, is crucial for a compliant and hassle-free experience.

Security Measures: Safeguarding Your Digital Investment

Security is a critical aspect of buying ETH with a credit card. Apart from securing your exchange account, it’s important to monitor your credit card statements for unauthorized transactions and be aware of phishing attempts or fraudulent platforms.

The Future of ETH and Credit Card Purchases

As the world of cryptocurrency continues to integrate with traditional financial systems, the ease of buying ETH with a credit card is likely to improve. This integration not only enhances accessibility but also signifies the growing acceptance and mainstream adoption of cryptocurrencies like Ethereum.

Conclusion: A Pathway to the Digital Frontier

In conclusion, the ability to buy ETH with a credit card is a significant milestone in the crypto journey. It represents a blend of convenience, accessibility, and the bridging of traditional and digital finance. For those looking to venture into the world of Ethereum, this method provides a straightforward and familiar path to participate in the digital currency revolution. As we move forward, the synergy between credit card transactions and cryptocurrency purchases will continue to evolve, paving the way for a more interconnected and digitally empowered financial future.