Ethereum: Evaluating the Juxtaposition of a Forecasted Dip and a Favorable Buying Window

The investment landscape in the world of digital currencies offers a multifaceted terrain, replete with opportunity and challenges. Among the most significant players in this domain is Ethereum, the blockchain platform that brought smart contracts to the forefront and fundamentally changed the cryptocurrency industry. In this piece, we will dissect our latest Ethereum price prediction and decipher what it means for prospective investors.

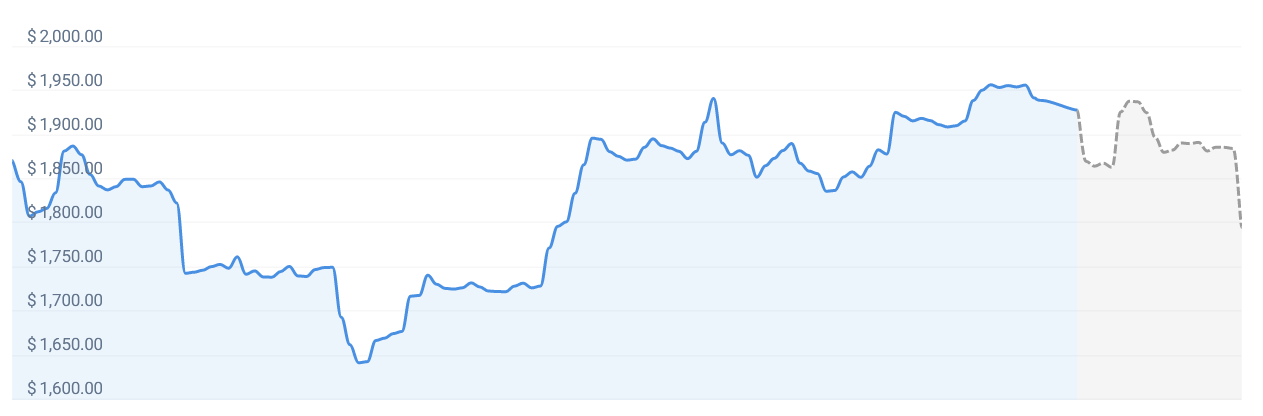

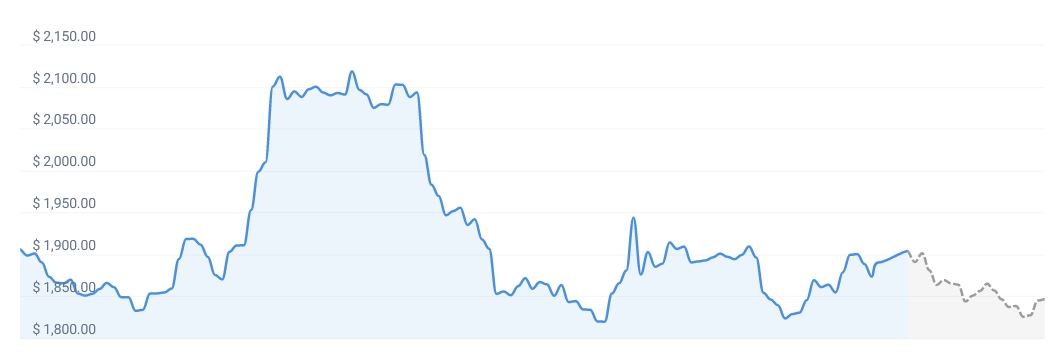

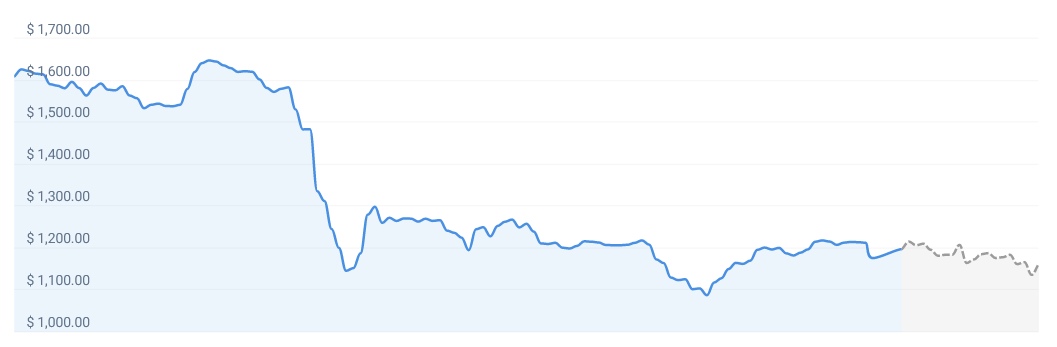

Our most recent prediction suggests a 7.01% decrease in the value of Ethereum, potentially reaching $1,795.86 by July 10, 2023. These forecasts are meticulously derived from various technical indicators, which offer insights into market trends and the cryptocurrency’s historical performance. Despite the expected drop, it’s worth reminding potential investors about the intrinsic volatility of cryptocurrencies, which frequently results in significant price swings.

Regarding the current market sentiment towards Ethereum, our technical indicators point towards a neutral perspective. This neutrality suggests a balance between buying and selling activities, indicating that the market may be awaiting impactful news or a shift in circumstances that could influence Ethereum’s future direction.

Meanwhile, the Fear & Greed Index for Ethereum presently stands at 61, placing it in the ‘Greed’ category. This intriguing contrast between the neutral sentiment and the high Fear & Greed Index illustrates the dynamic and often paradoxical nature of the cryptocurrency market. A high Fear & Greed Index implies that investors are currently optimistic, driven by the allure of significant returns despite the inherent risks, which can sometimes precede a market correction.

Looking back at the past 30 days, Ethereum has registered 16 green days out of 30, amounting to a positivity rate of 53%. A ‘green day’ in trading parlance signifies a day when the cryptocurrency’s price has increased from the preceding close. Alongside this positive trend, however, Ethereum has exhibited a price volatility of 4.42% over the last month, which, while not unusual in the world of cryptocurrencies, serves as a reminder of the risks associated with such investments.

Given these conditions, our current Ethereum forecast suggests that it might be a good time to invest in Ethereum. While the prediction implies a short-term dip, the overall circumstances — the neutral sentiment, a high Fear & Greed Index, and the positive performance over the last month — all hint at potential growth in the long run.

Despite the anticipated near-term decrease, it’s crucial to remember that Ethereum, like all cryptocurrencies, operates within an environment marked by volatility and unpredictability. Such market movements often represent opportunities for shrewd investors who understand the oscillating trends of the crypto market and are aware that immediate price movements do not necessarily dictate long-term patterns.

This forecasted drop could present a potential opportunity for investors who believe in Ethereum’s long-term potential. A lower entry point could prove profitable if Ethereum’s value rebounds following the predicted dip, as has been the case with numerous cryptocurrencies in the past.

In conclusion, investing in Ethereum, or any cryptocurrency for that matter, demands continual vigilance, a firm understanding of market dynamics, and the flexibility to adapt to ever-changing market conditions. While Ethereum’s price may be projected to drop in the near term, the broader outlook suggests the potential for future growth and profit. The volatile landscape of cryptocurrency is not for the faint-hearted, but for those who master its ebbs and flows, it can offer substantial rewards. In the words of ancient wisdom, fortune often favors the bold, and in the world of cryptocurrency, the bold are those who stay informed, patient, and adaptable.